Enables financial organizations to improve efficiency, enhance compliance and reduce processing times

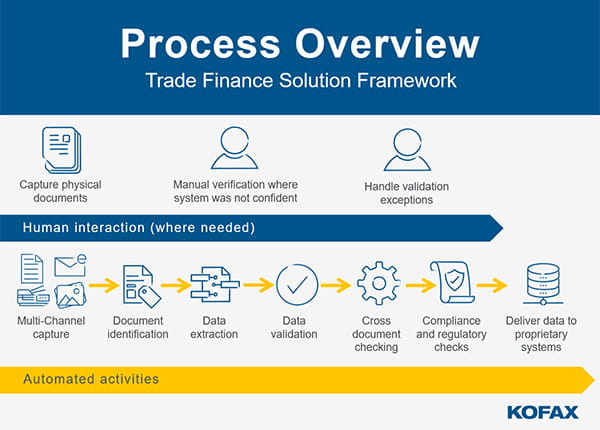

Irvine, CA – June 23, 2020 – Kofax®, a leading supplier of Intelligent Automation software for digital workflow transformation, today announces a new Trade Finance Solution. This low-code, configurable framework built on the Kofax Intelligent Automation platform accelerates end-to-end automation of trade finance workflows. The solution automates the processing of paper and electronic trade transaction documents – enabling banks and other financial institutions to improve efficiency, enhance compliance and reduce processing times.

“Intelligent automation and digital transformation are critical in the trade finance industry, especially now,” says Kurt Albertson, a Principal at The Hackett Group. “Trade finance professionals need to streamline efficiencies to stay compliant while improving accuracy.”

Trade finance is a time-consuming, document-intensive process. Settling one letter of credit can often require the processing and adjudication of 50 or more documents from multiple parties and days of adjudicating the inevitable inconsistencies. Expensive, labor intensive manual processing severely limits capacity and scalability, as well as exposing firms to potentially significant penalties for non-compliance. Automating these processes is complex due to the volume of documents per transaction, myriad entities involved and many disparate systems used. Lacking global standardization, less than 25 percent of banks currently use automated processes.

“Banks and other entities handling global trade finance each use varying processes to protect buyers and sellers and ensure trades are compliant. Kofax’s modular framework allows these entities to decide what their needs are, and easily create custom processes and workflows,” says Chris Huff, Chief Strategy Officer at Kofax. “The end result reduces the expense of conducting trade business by applying artificial intelligence and machine learning to automate the process throughout the workflow, resulting in greatly improved efficiencies.”

Kofax has built custom trade finance solutions for three of world’s largest banks and trade finance service providers, materially reducing expenses through more efficient and optimized processes. The new Trade Finance Solution Framework significantly improves time-to-value by including pre-trained trade documents, pre-defined Swift MT700 validation rules and operational dashboards for end-to-end process insight. Learn more during the Kofax Trade Finance webinar June 30.

About Kofax

Kofax enables organizations to Work Like Tomorrow™—today. Kofax’s Intelligent Automation software platform helps organizations transform information-intensive business processes, reduce manual work and errors, minimize costs, and improve customer engagement. We combine RPA, cognitive capture, process orchestration, mobility and engagement, and analytics to ease implementations and deliver dramatic results that mitigate compliance risk and increase competitiveness, growth and profitability. For more information, visit kofax.com.